There’s a really nice silver pairs trade being set up right now for investors that are agile enough, already set up for margin/short trading and understand the premise behind this pairs trade. Using the exact same concept I outlined previously for a gold pairs trade which worked out beautifully, there’s a nice market inefficiency (see more on arbitrage investments) to exploit in the difference between two silver instruments at the moment.

In short, we’d be going long and short an equivalent amount of money on two different funds simultaneously to capture the spread when we see a reversion to the mean in premium. I’ll explain more. But first, the ETF and the CEF (more on closed end funds):

- iShares Silver Trust (SLV) – This is the ETF that we will use as the proxy for the silver bullion price. SLV is the most commonly traded silver ETF and tracks the spot price of silver in real time relatively well. The strategy would entail taking a long position in SLV.

- Sprott Physical Silver Trust (PSLV) – This Sprott closed end fund has the added feature of allowing the investors to that actually allows for physical delivery of gold bars to investors in the trust on demand. While this entails considerable cost, hassle and security considerations, the mere notion that you can take custody of the silver that you believe you hold in shares of the trust provides a comfort to investors that the other ETFs and ETNs can’t. Therefore, investors are willing to pay a premium to the underlying net asset value of the fund (this is a common feature of CEFs; ETFs don’t trade at premiums/discounts). Contrary to the long position in SLV, the strategy would entail taking an equal short position in PSLV.

Strategy Outcomes

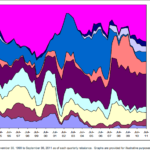

As of Thursday’s trading session, PSLV was trading at a hefty 24% premium. You can see real-time premiums on Sprott’s website. Take a look at where 24% lands – it’s OFF THE CHART!

(click to enlarge)

What’s telling is that this premium is not only WAY outside the historical norm, but what generally happens barring some sort of massive secular change in sentiment, is a reversion to the mean. So, one would reasonably expect that the premium will return to something along the lines of say, 15%. On a pairs trade, you could capture the 9% difference regardless of which way silver actually trades since you hold an equal dollar amount in both SLV and PSLV. You’re simply looking to profit on the decrease in premium and you don’t care at all about the actual direction or magnitude of the change in silver moving forward. When I employed this strategy for the gold pairs trade I alluded to earlier, it was complete within days for a nice gain of a few hundred bucks with minimal risk to me.

Personally, I attempted to enter into this pairs trade today, but alas, Ameritrade did not have the shares available to short at this time. I’ve tried to short various instruments over the years and sometimes the shares are available while sometimes they’re not. You may have better luck on a different day or with a different investment firm.

Your Downside Risk Profile

Of course, there’s no free ride. If for whatever reason the premium expands further, then the trade would move into the red. Of course, you only have a gain or loss when you close your trade, some short positions are known to be called in from time to time if the shares are no longer available to borrow. I’ve had that happen on occasion when shorting leveraged ETFs. While it would defy logic to see a continual or permanent 30%+ premium, stranger things have happened. I’d probably view the brokerage call-back of shares at the wrong time as the more likely scenario than a complete lack of reversion to the mean.

Disclosure: No position in either instrument highlighted in this article.

Source article ETFBase.com: Lucrative Silver Pairs Trade – If You Can Find the Shares to Short

{ 1 comment… read it below or add one }

I would guess that the reason that this trade hasn’t become overwhelmingly profitable is because of the capital gains implications with bullion. Both those funds, which hold physical instead of futures/financialized silver are subject to collectible tax rates. So, for the top-bracket, even trades > 1 year get whacked at 35%

{ 3 trackbacks }