I was a bit skeptical when I started to see “actively managed ETFs” popping up over the past couple years, so I thought I’d take a look at one of the larger ones and see how it’s performed vs. the broader market. In looking at the PowerShares Active AlphaQ (PQY), I was actually surprised by what I found. The fund invests in 50 NASDAQ-listed securities using proprietary methodology for weighting and trading. With the NASDAQ as its benchmark, I found that the fund beat out (QQQQ) in all recent time periods both up and down – and the S&P500 (SPY) as well incidentally.

Actively Managed ETF Key Statistics

Ticker: PQY

Expense Ratio: .75%

Assets: $21 Million

Return 1 month (vs. QQQQ): -2.2 vs. -2.9

Return 3 month (vs. QQQQ): -8 vs. -9.5

Return 6 month (vs. QQQQ): 0.5 vs. -1.1

Return 12 month (vs. QQQQ): 29 vs. 23

Actively Managed ETF Top Holdings:

Millicom International Cellular S.A.  2.82%

Citrix Systems Inc.  2.82%

DIRECTVÂ Â 2.60%

Netflix Inc.  2.57%

NetApp Inc.  2.46%

Ross Stores Inc.  2.46%

O’Reilly Automotive Inc.  2.44%

priceline.com Inc.  2.42%

Express Scripts Inc.  2.40%

SanDisk Corp.  2.35%

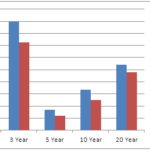

Impressive Returns

This actively managed ETF is doing something right. In all time periods evaluated, both up and down, PQY exceeded its benchmark index. In looking for a dividend yield, the fund has not payed out any dividends to date. When comparing the .6% dividend yield offered by QQQQ and the lower expense ratio, as long as the fund is outperforming by 1% annually, it appears to be paying off. At this point in time, the 1 year difference in performance is 6%, making a strong case for consideration of PQY.

Words of Caution

I couldn’t help but notice the ETF has very little trading volume, so little in fact, that sometimes hours go by without a single trade. So, what you run up against there is a lack of liquidity when you’re trying to unload shares and also the possibility of a wide bid-ask spread. So, you’ll want to proceed with caution if entering into a sizable position. Additionally, since the fund is comprised of NASDAQ stocks, it will tend to more more volatile than a broader market index like the S&P500 and of course, other safe investments with lower volatility that rely on income for net returns rather than capital appreciation. You’ll find no AAA Companies in this mix, but over time, the S&P500 and the NASDAQ don’t tend to diverge too much, just more of a Beta issue than anything else. Finally, the fund is relatively new and unproven and of course the mantra regarding past performance vs. future returns applies. However, based on several data points in both up and down markets, as it stands now, PQY makes the list of the Hottest ETFs beating the benchmarks.

Disclosure: No position in PQY

{ 0 comments… add one now }

{ 4 trackbacks }