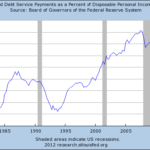

Treasury Yields continue to drift lower, breaking new records weekly it seems. Many attribute the current rate to investors baking in a substantial Quantitative Easing measure (dubbed QE2) to the tune of $500 Billion to $1 Trillion, as well as some substantial announcements out of Japan recently on their QE program. Even high yield muni bonds are seeing prices rise while yields continue to drop flying in the face of municipalities teetering on the brink of bankruptcy nationwide. There are a few forces at work here driving near term Treasury yields lower, but cause for concern of a spike later.

Factors Driving Treasury Yields Lower:

- QE2 Anticipation – already practically built in

- Specter of Sustained Period of Deflation

- Lack of Ability of Fed to Increase Rates due to Poor Economy, High Unemployment

- Political pressure to keep rates low to spur housing and economic recovery

Why Treasury Yields Will Eventually Spike:

- This Bubble Trade will unwind eventually, as they all do.

- Out of Control Deficits will demand higher interest rates from buyers

- Implied Inflation rate on TIPS increasing in outer years

- 10-Yr Treasury normally at 300 bps above Real GDP. 10 Yr below 2.5% Now. Latest GDP was positive 1.6%. Significant deviation from the mean.

- All Western currencies are Devaluing (See what Precious Metals and Gold ETFs are Telling us)

How to Short Treasuries

Based on the sheer magnitude of the problems in the country and the momentum of this trade, there’s no telling when we’ll see an exodus from Treasuries, but few would disagree that we will eventually see a reversal and 2.4% on the 10-Year is not sustainable. While I can now get 3.625% on a 15 year mortgage (insane but true, see for yourself), there is scant evidence the housing market is improving. The problem with shorting anything is the timing. If you’re too early to the game and go short, you may be squeezed out. If you buy a leveraged inverse Treasury ETF, you may lose money even in a flat market (due to value decay of leveraged ETFs). However, with proper risk management and strategies, there may be one that fits for you. Perhaps a combination of selling short long leveraged Treasury ETFs or perhaps it’s buying options on these ETFs. Maybe you have a pivot point at which you believe a particular duration Treasury cannot exceed. Calculate that ETF price point and you can sell a call at that stike. There are numerous ways to be effectively short on treasury bonds and those are just a few. Regardless of your strategy, here are several Treasury ETFs to choose from:

(TBF) ProShares Short 20+ Year Treasury (2x)

(PST) ProShares UltraShort 7-10 Year Treasury (2x)

(TBT) ProShares UltraShort 20+ Year Treasury (2x)

(TMF) Direxion 30 year Treasury Bull 3x ETF

(TMV) Direxion 30 year Treasury Bear 3x ETF

(TYD) Direxion 10 year Treasury Bull 3x ETF

(TYO) Direxion 10 year Treasury Bear 3x ETF

(TWOL) Direxion 2 year Treasury Bull 3x ETF

(TWOZ) Direxion 2 year Treasury Bear 3x ETF

(LBND) PowerShares DB 25+ Year Treasury Bond Bull 3x ETF

(SBND) PowerShares DB 25+ Year Treasury Bond Bear 3x ETF

What’s Your Preferred Play to Short Treasuries?

{ 6 comments… read them below or add one }

I like the idea, but highly risky play considering the Federal Reserve’s intervention via POMO.

Yup, timing’s a bitch. I haven’t pulled the trigger yet; if 10-Yr hits low 2s, I will start backin’ up the truck.

The 10 year will hit 2%, it’s just a matter of when.

The major catalyst for the scenario you describe will likely be a rise in interest rates – so what about short selling interest rate futures now (eg eurodollar futures are possibly at approaching a pivot point) rather than shorting Treasuries?

I’ve used TBT in a couple cases on a very small basis with a couple of clients. Obviously not too happy so far in ’10 but time might prove this to be a good investment. Like any type of shorting we have to figure out what we are trying to accomplish and set limits. I have a more active ETF allocation model that I am beginning to use, I have incorporated an inverse equity ETF, may need to do the same on the fixed income side.

Leveraged ETFs are great… for the ETF’s fund managers. Anyone else using them will lose their money. These ETFs will fleece you for exorbitant fees while delivering zero value.

{ 1 trackback }