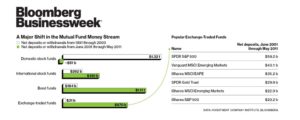

This weekend, BusinessWeek did a comprehensive piece on the decline of the actively managed mutual fund in America. The trend of seeing money shift from actively managed funds to passive ETFs shouldn’t come as a surprise, but the magnitude and unabated shift of flows seems to spell the death of the old actively managed mutual fund model I grew up with. Gone are the days of vaunted fund managers like Peter Lynch and enter the index ETFs. This chart pretty much tells it all, but I’ve added some data and commentary as well:

(click to enlarge)

The data is pretty staggering. During a period where ETF inflows zoomed from a mere $31Billion in Assets in the 90s to $870Billion from 2001-2011 , domestic mutual funds actually saw a DECLINE in the most recent 10 year period, losing $51 Billion in Assets. You read that right, there was net decline in assets in mutual funds. On one hand, one might explain this as the “lost decade” in equities returns during the prior 10 years, but that could easily be countered with the phenomenal growth ETFs have seen during the same exact period. It’s simple, ETFs are Better Than Mutual Funds. Mutual fund managers have just not proven themselves to be any better than indices, but with higher costs, tax liabilities and several other downsides. Rather than worry about lavish pay and retention of top fund managers, investors can just set it and forget it in anything from high yield ETFs to micro-niche plays like the Cloud Computing ETF.

TOP ETFs of the Decade

From June 2001-May 2011, the ETFs seeing the top inflows were the following:

- SPY (SPDR S&P500) – $59 Billion

- VWO (Vanguard MSCI Emerging Markets) – $40 Billion

- EFA (iShares MSCI EAFE) – $35 Billion

- GLD (SPDR Gold Trust) – $30 Billion

No real surprises there given the headlines that gold and emerging markets have grabbed during the past several years; perhaps it’s just interesting to note that a select few ETFs have garnered such vast inflows when several other alternatives exist in each category. Low cost, name recognition and early entrance into the market are certainly key drivers for each of the above. I was also a bit surprised to see no bond ETFs in the top several spots – presumably they haven’t caught on yet with investors to the same degree that equities and commodities ETFs have.

So, do these trends spell the end of the actively managed mutual fund as we know it? Possibly. While there will still always be a niche for active management with a proven track record or strategies that an ETF can’t employ (which are few), as outflows continue, the cost structure of many of the largest mutual funds will become less attractive and firms will have to either continue to run them as loss leaders, increase add spending – or actually outperform benchmarks, which decades of research has shown to be very difficult. What I’m waiting for is the day when all major corporate retirement accounts begin offering low-cost index ETFs over broad market actively managed mutual funds.

What Are Your Thoughts? Are Mutual Funds Dead?

Disclosure: The author is long SPY, GLD. No positions in any other investments cited in this article.

{ 1 comment… read it below or add one }

Interesting article and certainly ETFs have and will continue to experience growth. As a financial advisor I use them in client portfolios extensively. However I also use closed-end mutual funds as well as both active and index mutual funds. In short I look for the right “tool” for a particular client’s situation. I feel that it is great to have these choices available to me. Are mutual funds dead? I doubt it. Will some of the really bad ones die? I sure hope so.