A friend of mine is in institutional sales of funds to 401(k) plans for major corporations. We got on the topic of what sort of funds he sells markets to companies and why most major corporations have such lousy investment options for employees. He had a very telling exchange with one Treasury officer at a major corporation. When asked why they didn’t want to offer their employees more aggressive investment options like emerging markets funds, the officer of the company simply replied, “We’re offering our employees options but we’re not opening ourselves up to lawsuits”. That pretty much says it all. Companies would sooner offer employees lower-risk, and often substandard funds rather than funds that are more volatile like emerging markets, commodities, currencies, etc. They don’t want to be sued by their employees for offering funds that experience massive losses (even though the employees select their investments – but this is America after all). I understand the notion that most retail investors (employees) should not be dabbling in retirement plan speculation of where gold is going next or whether the Euro will implode. However, if you take a look at the offerings in your retirement plan, I’ll be most of you would agree it’s very light on emerging markets opportunities. I know mine has no such investment option whatsoever out of over a dozen investment options.

Why You Need Emerging Markets Exposure

Since you probably can’t get this exposure in your 401(k) or equivalent and that’s where most people tend to accumulate the largest amount of total equity assets over time given a company match and automatic payroll deduction, it’s worthwhile considering how to bolster emerging markets exposure either through mutual funds or ETFs. But first, why you actually need emerging markets exposure.

- Too US-centric – Historically, US equities have been a great place to invest. The US continues to be the safe haven when global conflagrations arise and continues to be the primary financial and military superpower of the world. But the world is changing. We will soon see China surpass the US in terms of GDP, demographics are working against us and if we can learn anything from the debt crisis in Europe, it is evident that one of two things is coming: austerity measures which will crimp growth OR a currency crisis once the markets move past debt restructuring in Europe. Just because you live in America, it doesn’t mean you should have a US-centric portfolio. It’s akin to holding too much (or any) company stock, right? It’s stacking your risk rather than diversifying it.

- It’s NOT Europe – Many funds in retirement plans that have the word “International” are pretty much just heavily weighted European funds, sometimes with some Japan and Latin America mixed in. Europe is growing very slowly as well and aside from smaller eastern block countries that aren’t already part of the Eurozone, these aren’t “emerging markets”. They’re primarily old-Europe, heavily weighted toward the same countries experiencing a debt crisis and austerity measures of their own.

- Where the Growth Is – Most of the top emerging markets are anticipated to grow at a much faster rate than western markets. Not only are the populations younger and have a higher birth rate, but these economies are expanding exports of goods, services and commodities. The spread in growth between developed markets and emerging markets is anticipated to be significant. GDP growth generally translates into momentum in corporate profits locally, which should drive stock prices, assuming we don’t see a deceleration in P/E ratios.

- The Fall of the West, Rise of the Rest – Most people in the US and Europe haven’t really accepted this yet, but the game is over. After riding a wave of decades of opulent deficit spending and making unsustainable entitlement commitments, there needs to be a reconciliation. We’re already seeing it in the deficit commission recommendations, the recent federal pay freeze announcement, and what the bond markets are telling us post QE2. Even in spite of a potential collapse of the entire Euro as a result of continuous bailouts, US bond yields are actually higher than they were before QE2 was even conceived. So, even $600 Billion didn’t buy us lower rates. The markets are and will continue, to command higher interest rates to fund our debt, which will ultimately result in the end of an era of free spending (and artificial domestic growth).

- Diversification – While we found in the 2008-2009 crash that emerging markets are not decoupled as many had previously believed, outside of a global crisis, emerging markets do provide some diversification in both returns, volatility, currency changes, commodities booms and other indirect benefits that you wouldn’t generally get from investing in US stocks alone.

- Income Investments are Few and Far Between – Save for some lesser-known strategies like MLP Investments and high yield ETFs, there are very few income plays even worth considering given where interest rates and money printing have driven safer yields.

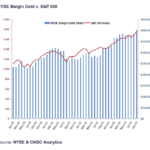

These aren’t just platitudes. Most investment advisors you talk to would advocate for at least some meaningful portion of a balanced portfolio to be dedicated to emerging markets equities. For more risk/speculation, there are even frontier markets. With the S&P500 (SPY) up 75% from the pivot bottom in March 2009, it may be unreasonable to continue to expect the long-run average 8-10% returns in US equities over the next several years. Bonds have likely run their course as well with yields at record lows and an increasingly loud chorus of naysayers pointing to a massive bond bubble collapse on the horizon. That leaves emerging markets equities as a key asset class. While valuations may appear to be rich as well given the flow of funds from US equities to emerging markets equities over the past several months, when looking at a long-term perspective, it seems like a pretty sound investment and the opportunity cost of avoiding these markets altogether could be quite high.

Best Emerging Markets ETFs

While there are dozens of single country and regional Emerging Markets ETFs out there, for the typical long-term retail investor, a key focus should be broad diversification and low expense ratios. As such, popular ETFs that fit the bill would be the following:

(VWO) Vanguard Emerging Markets ETF – Expense Ratio 0.27%;Â YTD Return: up 15%

(EEM) iShares MSCI Emerging Index Fund – Expense Ratio 0.72%;Â YTD Return: up 11%

(GMM) SPDR S&P Emerging Markets ETF – Expense Ratio 0.59%;Â YTD Return: up 13%

* S&P500 YTD Return is up 8%

Each of these funds have a separate makeup and country weighting, but they are all highly diversified with dozens of holdings each and no one company comprising more than just a few percentage points of the total makeup. Over long periods of time, they track pretty closely together and which one will outperform from here is anyone’s guess. They certainly look nice in a US-centric portfolio though.

Disclosure: No position in any ETFs cited here; multiple emerging markets ADRs held though.

{ 5 comments… read them below or add one }

First off I would implore you not to minimize the Fiduciary aspect of running a 401(k) plan. As one who advises plan sponsors the threat of lawsuits are very real and the regulatory climate is a minefield. That said I see a lot of plans with lousy funds, high expenses, and a poor selection to boot.

One other good point about the Vanguard Emerging Market ETF is the fact that there are no front or back end charges as there are with the mutual fund version.

My point exactly. Just further illustrates why plan funds are so – mediocre. Usually can’t go wrong with Vanguard. Ethical, low cost, best in the biz.

I’d like to think that we put some pretty decent fund line-ups in place for our plan sponsor clients and their employee participants. I am a Vanguard fan, but like any fund company I’d be loath to say that I would recommend all of their funds. I think one of the main problems with many 401(k) plans is that many participant are just not comfortable making their own investment decisions. I’m probably biased here as a partner and I are starting a firm to provide direct advice to participants. If you are interested in taking a look our site is http://retirementfiduciaryadvisors.com/.

Why do the EM ETFs lag BRIC & frontier ETFs so much?

What’s the best way to hedge a portfolio of hot ETFs?

Depends on time period you’re looking at, but generally, in an up market, the highest beta positions will win out (likewise on the way down). Frontier markets are riskiest, and hence, deliver biggest gains in a rising tide.

Best way to hedge? Many ways, each with tradeoffs: put options are simplest but costly over time. inverse etfs, shorting long etfs, out of money calls, etc. pretty complex. perhaps best to just take some profits and lighten up on holdings if unsure?

{ 3 trackbacks }